Plan Today, Protect Tomorrow: Navigating Estate Planning with Confidence

Secure Your Legacy: Essential Strategies for Estate Planning

Prepare for the future with confidence by mastering the essentials of estate planning. This focused seminar delves into the critical components of safeguarding your legacy – understanding estate planning and the tools necessary to ensure your wishes are honored. Gain expert insights and practical strategies to navigate the complexities of estate panning, providing peace of mind for you and your loved ones.

What can you expect to learn from this class?

Gain clarity on how wills and various types of trusts (such as revocable and irrevocable) function, and determine which options best suit your estate planning needs.

Learn strategies to bypass the probate process, saving time and reducing expenses for your heirs.

Understand how to keep your estate matters private and ensure your wishes are carried out without court intervention.

Explore tax-efficient strategies to reduce the burden of estate and inheritance taxes on your beneficiaries.

Recognize the importance of regularly reviewing and updating your estate plan to reflect life changes and new laws.

Discover methods to safeguard your assets against the high costs of nursing home care and other long-term care expenses.

Navigate The Complexities Of Estate Planning With Confidence

This informative seminar is designed to equip you with the knowledge and strategies necessary for effective estate planning. You'll explore the differences between wills and trusts to make informed decisions about asset distribution.

Estate planning isn’t just for the wealthy—it’s essential for anyone who wants to ensure their wishes are honored and their loved ones protected. A will provides clear instructions for how your assets should be distributed, while a trust can help you avoid probate, maintain privacy, and provide greater control over how and when assets are passed on. Together with other estate planning tools, these documents can minimize taxes, reduce family conflict, and ensure your legacy is preserved exactly as you intend.

By taking the time to understand your options now, you can create a clear, customized plan that brings peace of mind to you and your loved ones. Whether you’re just starting or need to update an existing plan, this seminar will empower you to take meaningful steps toward protecting what matters most.

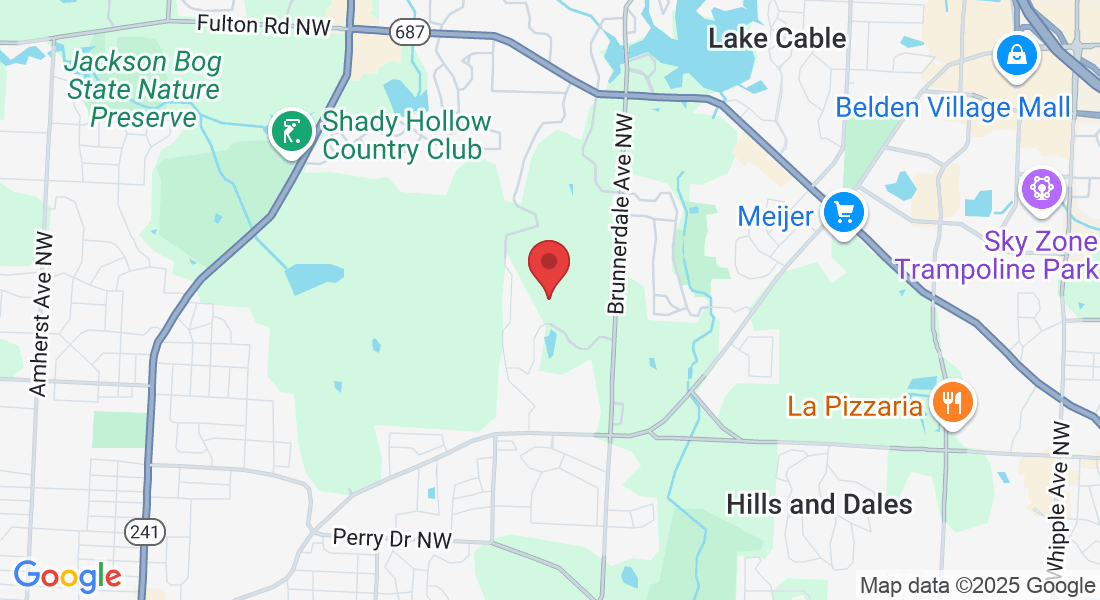

Register to join us at Glenmoor Country Club – The Historic Bertram Inn for this informative class focused on estate planning on May 28th from 1:00 PM.

Space is limited. Sign up today!

WEDNESDAY

May

28

1:00 PM

This session delivers up-to-date guidance on the key obstacles in estate planning and how to overcome them. Learn how to structure your estate to avoid unnecessary taxes, protect your beneficiaries, and maintain control over how your assets are managed and distributed. By the end of the class, you'll be equipped to build a solid estate plan that reduces financial and emotional burdens on your loved ones—and helps you leave the legacy you intend.

Frequently Asked Questions

Who is this seminar for?

The insights provided in our estate planning seminar are valuable for anyone seeking to protect their assets, provide for loved ones, and ensure their wishes are honored.

What's the purpose of this class?

This class is designed to be entirely educational, providing attendees with valuable insights into key aspects of estate planning.

Topics covered include:

• The pros and cons of beneficiary designations

• The pros and cons of Trusts

• The costly mistakes people make when trying to avoid probate

• Common planning mistakes that cause unnecessary taxes for you and your heirs

• The essential legal documents everyone should have and why

• And much more...

* As a bonus, all attendees will receive complimentary copies of Understanding Estate Planning: Next Generation Estate Planning For Modern Lives.

While presenters may offer business cards or brochures for informational purposes, there is no obligation to interact with them during or after the class.

Who is the speaker/presenter?

Will Parries & Ron Fleming are Managing Partners at Estate Plan 4 You, a firm dedicated to educating families and individuals on the critical importance of proper estate planning. With a background in financial education and a passion for helping others prepare for the future, Will & Ron have both led hundreds of families through the often-overlooked process of building a sound estate & financial plan. Together the two have developed a unique approach to estate planning seminars—offering accessible, easy-to-understand guidance designed to help attendees take control of their legacy and make informed decisions that protect their loved ones.

Will & Ron share a deep commitment to helping individuals and families understand the importance of proper estate planning. They have been instrumental in developing advanced estate planning education strategies—especially those that highlight how to protect and preserve assets in a variety of real-life situations, including large and small IRAs, family businesses, working families, high-net-worth individuals, blended families, retirees, and farming families across Ohio.

They’ve worked extensively to create practical solutions that address common trust and estate planning concerns and offer solutions to empower families to put effective plans in place—without relying on one-size-fits-all approach. At the heart of their mission is one goal: to make estate planning approachable, understandable, and actionable for everyone.